Market Prediction: Just a few days ago, fear gripped the entire market — panic was everywhere. The Russia-Ukraine conflict, Trump’s trade war, India-Pakistan tensions, and a soaring India VIX (22-23) had investors and traders worried. But then, silence. The noise faded, confidence returned, and smart money started entering the market again.

On Monday, the market surged with a bang — Sensex jumped 3000 points and Nifty rallied over 800 points. But the very next day, we witnessed a sharp correction of 300-400 points. Today, Nifty traded within yesterday’s range and closed near the lower end.

The situation is uncertain and challenging, but by analyzing data and price action, we aim to uncover what could come next. Let’s dive into the insights. Market Prediction 15th May.

Table of Contents

Market Overview – A Pause Before the Action

🔍 Nifty 50 Snapshot

| Open | High | Low | Close |

| 24,613.80 | 24,767.55 | 24,535.55 | 24,666.90 |

📊 Market Breadth (Nifty 50)

| ADVANCED | FLAT (<0.25%) | DECLINES |

| 32 | 9 | 9 |

📈 Nifty Movers

| TOP GAINERS | GAIN % | TOP LOOSERS | LOSS % |

| TATA STEEL | 3.93 % | ASIANPAINT | – 1.66% |

| SHRIRAMFIN | 2.75 % | CIPLA | – 1.33 % |

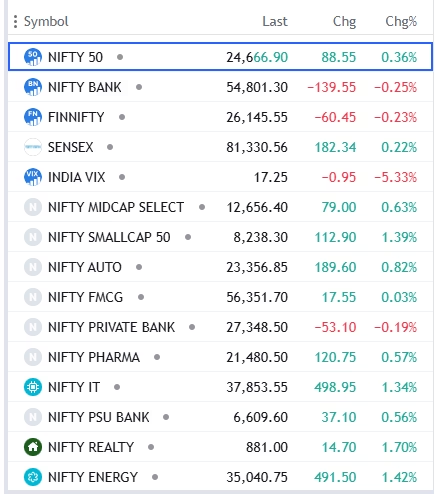

🏦 Nifty Sectoral Performance

- Overall sectoral performance was bullish.

- All sectors closed in green, except Private Bank which ended slightly in red (-0.19%).

- Top Gainers: Realty & Energy sectors with ~1.5% gains.

- Midcap & Smallcap: Closed in green.

- (📊 Check chart for detailed sector-wise performance)

🔍 Technical Analysis – Is This Pause Significant?

Nifty is consolidating near a resistance zone. 24,860 is proving to be a hurdle. The price structure suggests the market is preparing for an upside breakout while consolidating near support.

Key Levels:

- Support: 24,550

- Resistance: 24,860

RSI 14

- Daily: RSI is taking support near 60. If it crosses 70, bullish momentum will strengthen.

- Hourly: RSI is stabilizing around 50. A move above 60 could push it towards 80.

📊 Open Interest (OI) Data

- Max OI (PE): 24,600 ➜ 76 Lakh (Support)

- Max OI (CE): 24,700 ➜ 86 Lakh (Resistance)

🧮 OI Build-Up:

| Index | PRICE % | OI % | BUILDUP |

| NIFTY | 0.36% | – 2.91 % | Short Covering |

| BANK NIFTY | -0.25% | 3.42 % | Short buildup |

| FINNIFTY | -0.23% | – 1.17 % | Long Unwinding |

- Interpretation: Mixed signals suggest a sideways bias for now.

🌐 FII & DII Data (Will Update Soon)

FII : Cr. Sell in Cash

DII : Cr. buy in Cash

🧠 Market Prediction & Trade Plan

Media and influencers remain bullish, but the current OI structure tells a different story. The market may remain range-bound unless key levels break.

If Nifty breaks 24,800:

- Expect a rally toward 25,000

If Nifty breaks below 24,550:

- Likely to slide toward 24,350

Important Note: Falling India VIX indicates quick premium decay — options buyers must act swiftly. Expect choppy sessions ahead.

Strategy:

- Mark today’s low as a key support.

- Below that, downside of 200-250 points is likely.

- Trade light and protect capital.

📘 Key Learning from Today’s Market

- When VIX falls, premiums melt fast. Momentum trades need quick entries and exits.

- Capital protection is the first rule in options trading.

- Always define your risk and follow stop-losses.

Want to learn Option trading, or wanted to Improve your trading skill, Please check our Learn section for Profitable and simple strategies and many more.

Also, Check your Financial Horoscope Weekly to find the perfect timing for trades and Market Predictions. Click the link Below.

📣 What’s Your Take?

Do you think ******?

💬 Drop your thoughts in the comment section!