Market Prediction: Today, all major indices opened with a mild gap-up and quickly broke early resistance levels. Nifty surged past 24,365, hitting a high of 24,457 in the first 30 minutes. However, it couldn’t sustain the strength and fell back to yesterday’s range, entering a tight sideways movement for the rest of the session.

By the close, Nifty ended nearly flat (+0.03%), Sensex gained 0.09%, and Bank Nifty slipped -0.07%. This narrow-range day raises the big question—was this an accumulation phase before expiry, or just another sideways session?

With a market holiday after tomorrow (1st May – Maharashtra Day), this week’s expiry is preponed to 30 April. India VIX is climbing steadily, hinting at a potential sharp move. Let’s decode the data and price action for accurate expiry day prediction.

Join up on Whatsapp Channel to get Daily Market Updates. Click Here

Market Prediction- TOC

Click to jump directly to your desired section.

Market Overview – A Pause Before the Action

🔍 Nifty 50 Snapshot

| Open | High | Low | Close |

| 24,370.70 | 24,457.65 | 24,290.75 | 24,335.95 |

📊 Market Breadth (Nifty 50)

| ADVANCED | FLAT (<0.25%) | DECLINES |

| 16 | 8 | 26 |

📈 Nifty Movers

| TOP GAINERS | GAIN % | TOP LOOSER | LOSS % |

| TRENT | 5.77 % | SUNPHARMA | – 2.25 % |

| BEL | 3.97 % | ULTRACEMCO | – 2.18 % |

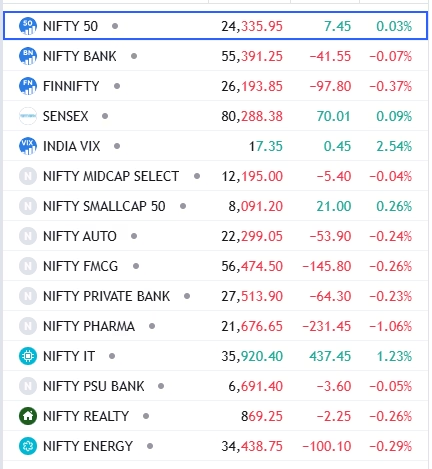

🏦 Nifty Sectoral Performance

- Top Gainer: IT Sector +1.25%

- Top Loser: Pharma -1.06%

- Other sectors saw minor changes (mostly negative), under 0.3%

Check the chart for entire sectoral performance.

🔍 Technical Analysis – Is This Pause Significant?

It’s the 5th straight session where Nifty closed near 24,350, yet again failing to hold above it. This suggests indecision—neither strength nor weakness—but clear respect for the 24,300 support.

With the April monthly candle about to close and a 12% monthly gain already in the bag, tomorrow’s price action can be significant.

Key Levels:

- Support: 24,200 – 24,120

- Resistance: 24,365 – 24,790

Indicators:

20 SMA (Hourly): At 24,225, which could act as a retracement level

India VIX: Above 17 and rising ⬆️

RSI 14:

Daily Chart: ~65 and flattening

Hourly Chart: ~58 and flat

📊 Open Interest (OI) Data

- Max OI (Support) – 23,300 (PE OI – 1.23 Cr.)

- Max OI (Resistance) – 23,400 (CE OI – 1.55 Cr.)

🧮 OI Build-Up:

| Index | PRICE % | OI % | BUILDUP |

| NIFTY | 0.03% | 5.97% | Long Buildup |

| BANK NIFTY | -0.07% | -2.24% | Long Unwinding |

| FINNIFTY | -0.37% | 2.7% | Short Buildup |

🌐 FII & DII Data (Will Update Soon)

FII : Cr. Sell in Cash

DII : Cr. buy in Cash

🧠 Market Prediction & Trade Plan

The market is still range-bound, with no decisive long or short interest visible in today’s expiry data. Unless Nifty crosses today’s high (24,457) on an hourly chart, it may stay sideways.

A breakout above that level could open gates to 24,800. However, rising VIX suggests caution. If any negative trigger hits the market, volatility could surge fast.

Caution: Rising VIX + Resistance zone = Avoid aggressive long positions.

Disclaimer:

This blog post is intended solely for educational purposes. All information shared here is based on publicly available data, news reports, and personal analysis.

We do not provide any buy or sell recommendations. Investment in stock markets is subject to market risks. Always consult with a SEBI-registered financial advisor before making any investment decisions.

The author and this website assume no responsibility for any financial losses or gains incurred based on the information provided in this article.

📘 Key Learning from Today’s Market

- If the first candle is >100 points, chances of a sideways day are high unless high/low gets broken.

- A rising VIX with price near resistance often leads to sideways action or sharp reversal.