Market Prediction: Our prediction from yesterday turned out to be spot on! Everything unfolded exactly as per the plan. The breakout above 24,700 fueled a powerful rally that pushed Nifty toward 25,100.

While most traders were expecting a fake breakout or a sideways expiry, we remained confident based on our data points. The breakout of 24,700 confirmed a strong bullish move—and the market didn’t disappoint.

Today’s session gave traders multiple opportunities to recover previous losses or book impressive gains. Nifty gave a one-sided rally after testing the 24,600 level in the morning. Option premiums exploded, with 24,600 CE jumping from ₹50 to ₹500!

But remember—markets never stop. If today didn’t work out for you, don’t worry. Bigger momentum is ahead. Let’s dive into the charts and data to decode the Market Prediction for 16 May.

Table of Contents

Market Overview – Action Started

🔍 Nifty 50 Snapshot

| Open | High | Low | Close |

| 24,694.45 | 25,116.25 | 24,494.45 | 25,062.10 |

📊 Market Breadth (Nifty 50)

| ADVANCED | FLAT (<0.25%) | DECLINES |

| 47 | 2 | 1 |

A super strong breadth. Almost the entire Nifty pack joined the rally.

📈 Nifty Movers

| TOP GAINERS | GAIN % | TOP LOOSERS | LOSS % |

| HEROMOTOCO | 5.48 % | INDUSINDBANK | – 0.40 % |

| JSWSTEEL | 3.71 % |

Only one stock in red!

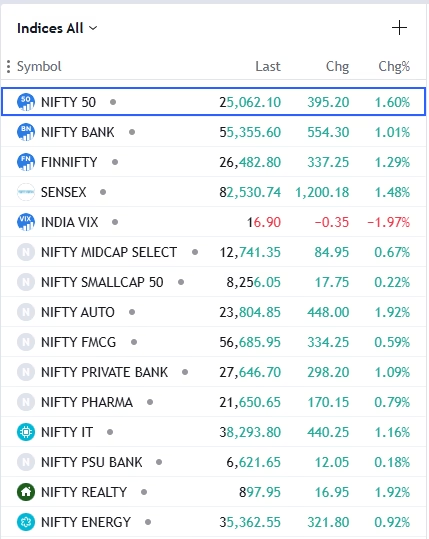

🏦 Nifty Sectoral Performance

- All sectors ended in green, showing broad-based participation.

- Top Gainers:

- Nifty Realty: +1.92%

- Nifty Auto: +1.92%

- PSU Banks: Flat with a +0.18% uptick

- India VIX: Down by 2%, currently at 16.90, suggesting declining fear and premium decay.

🔍 Technical Analysis – Super Candle Made.

Market Prediction: We often say, a clean breakout is either supported by a gap-up or a super candle. Today, we got the latter. The strong bullish candle confirms the breakout, and signals that the price is now in uptrend.

Every dip from here can be a buying opportunity.

Key Levels:

- Support: 25,000, 24,950

- Resistance: 25,250, 25,800

RSI 14

- Daily Timeframe: Rising from 60, now at 66. Next resistance levels: 70 → 80

- Hourly Timeframe: Currently at 67, moving toward 80+

📊 Open Interest (OI) Data

We have considered Upcoming expiry data for better clarity. Fresh data may build tomorrow.

- Support (PE OI): 25,000 PE ➜ 40.32 Lakh OI

- Resistance (CE OI): 25,500 CE ➜ 44 Lakh OI

🧮 OI Build-Up:

| Index | PRICE % | OI % | BUILDUP |

| NIFTY | 1.45% | 11.98 % | Long Buildup |

| BANK NIFTY | 0.85% | 4.65 % | Long Buildup |

| FINNIFTY | 1.04% | 2.53 % | Long Buildup |

- 📌 When we combine upcoming May expiries, strong support is building around 25,000.

🧠 Market Prediction & Trade Plan

The next target on the chart is 25,230. If Nifty closes above 25,230, we may witness a fresh bullish wave of 800–1000 points.

However, a close below 24,900 would signal a pause or consolidation in the current uptrend.

🚨 Trade Cues:

- Above 25,230: Target 25,800+

- Below 24,900: Possible pullback to 24,700–24,600

📘 Key Learning from Today’s Market

- A breakout with a super candle = strong confirmation.

- Premiums explode during such directional rallies.

- Master the skill of risk control and timely entry/exit.

You can learn profitable and simple strategies from us. Click the link below.

This blog post is intended solely for educational purposes. All information shared here is based on publicly available data, news reports, and personal analysis.

We do not provide any buy or sell recommendations. Investment in stock markets is subject to market risks. Always consult with a SEBI-registered financial advisor before making any investment decisions.

The author and this website assume no responsibility for any financial losses or gains incurred based on the information provided in this article.

📣 What’s Your Take?

Do you think ******?

💬 Drop your thoughts in the comment section!